Withdraw Your PF Amount Online?

Workers’ Provident Fund (EPF), likewise alluded to as Withdraw Your PF Amount Online? (Provident Fund), is a mandatory savings cum retirement scheme for employees of eligible organizations. The employees can access the corpus of this fund post-retirement. According to the EPF rules, the employees should contribute 12% of their basic salary to this fund regularly. The employer contributes a matching amount to the employee’s PF account. The amount saved in EPF accounts earns interest on an annual basis. Workers can withdraw the entire sum accumulated in their EPF once they retire. Nonetheless, this article explains how one can Withdraw Your PF Amount Online? and make premature withdrawals from the EPF account after meeting certain conditions.

Most recent Update:

The public authority has expanded the EPF loan cost to 8.25% for the monetary year 2023-24.

PF Updates:

On April 16, 2024, the EPFO issued a circular increasing the partial PF withdrawal limit from Rs. 50,000 to Rs. 1 lakh for auto-approved medical treatment claims.

Starting from FY 2021-22, interest earned on an employee’s contribution to an EPF account exceeding Rs. 2.5 lakh during the financial year is taxable in the hands of the employee. This interest is also subject to TDS under Section 194A.

How to Withdraw PF Amount?

How to Withdraw PF Amount?

Comprehensively, EPF withdrawals can be made either by submitting:

1. Physical application

2. Online application

Physical Application

Download the new Composite Claim Form (Aadhaar) or Composite Claim Form (Non-Aadhaar) to withdraw the EPF balance.

Composite Claim Form (Aadhaar)

• Use the Composite Claim Form (Aadhaar) if your Aadhaar and bank details are seeded in the UAN portal and your UAN is activated.

• Fill and submit the form to the respective jurisdictional EPFO office without the employer’s attestation.

Composite Claim Form (Non-Aadhaar)

• Use the Composite Claim Form (Non-Aadhaar) if your Aadhaar and bank details are not seeded in the UAN portal.

• Fill and submit the form with the employer’s attestation to the respective jurisdictional EPFO office.

Note: In the case of partial withdrawal of the EPF amount by an employee for various conditions, the requirement to furnish various certificates has been reduced, and the option of self-certification has been introduced for EPF subscribers. (For details, refer to the EPFO order dated 20.02.2017)

Online Application

The EPFO has introduced an online withdrawal facility, making the entire process more convenient and less time-consuming.

Requirements

To apply for the withdrawal of EPF online through the EPF portal, ensure the following conditions are met:

• The Universal Account Number (UAN) is activated, and the mobile number used for activating the UAN is in working condition.

• The UAN is linked with your KYC, such as Aadhaar, PAN, bank details, and the IFSC code.

If the above conditions are met, there is no need for the previous employer to authenticate your withdrawal application.

Steps to Apply for EPF Withdrawal Online on the UAN Portal

Step 1: Visit the UAN portal.

Step 2: Log in with your UAN and password. Enter the captcha and click on the ‘Sign In’ button.

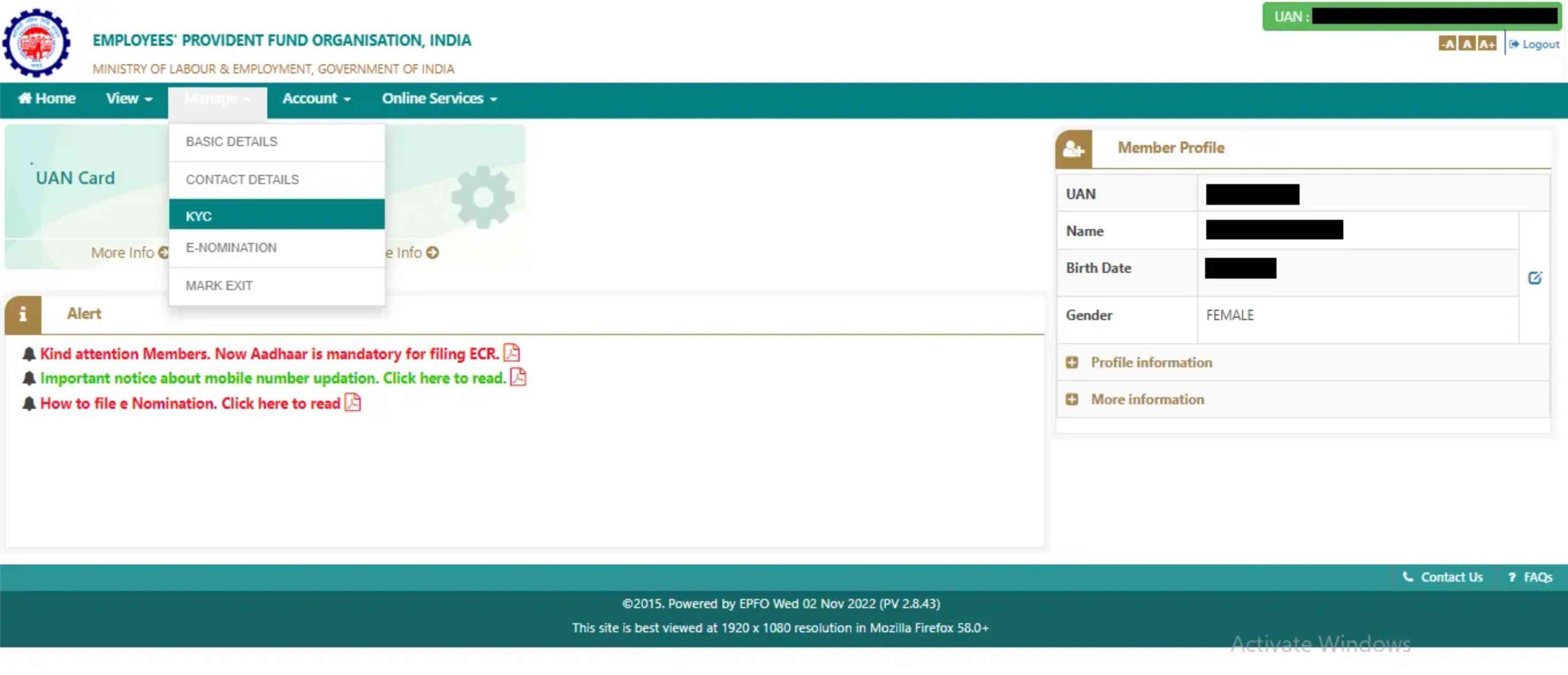

Step 3: Click on the ‘Manage’ tab and select ‘KYC’ to check whether your KYC details, such as Aadhaar, PAN, and bank details, are verified.

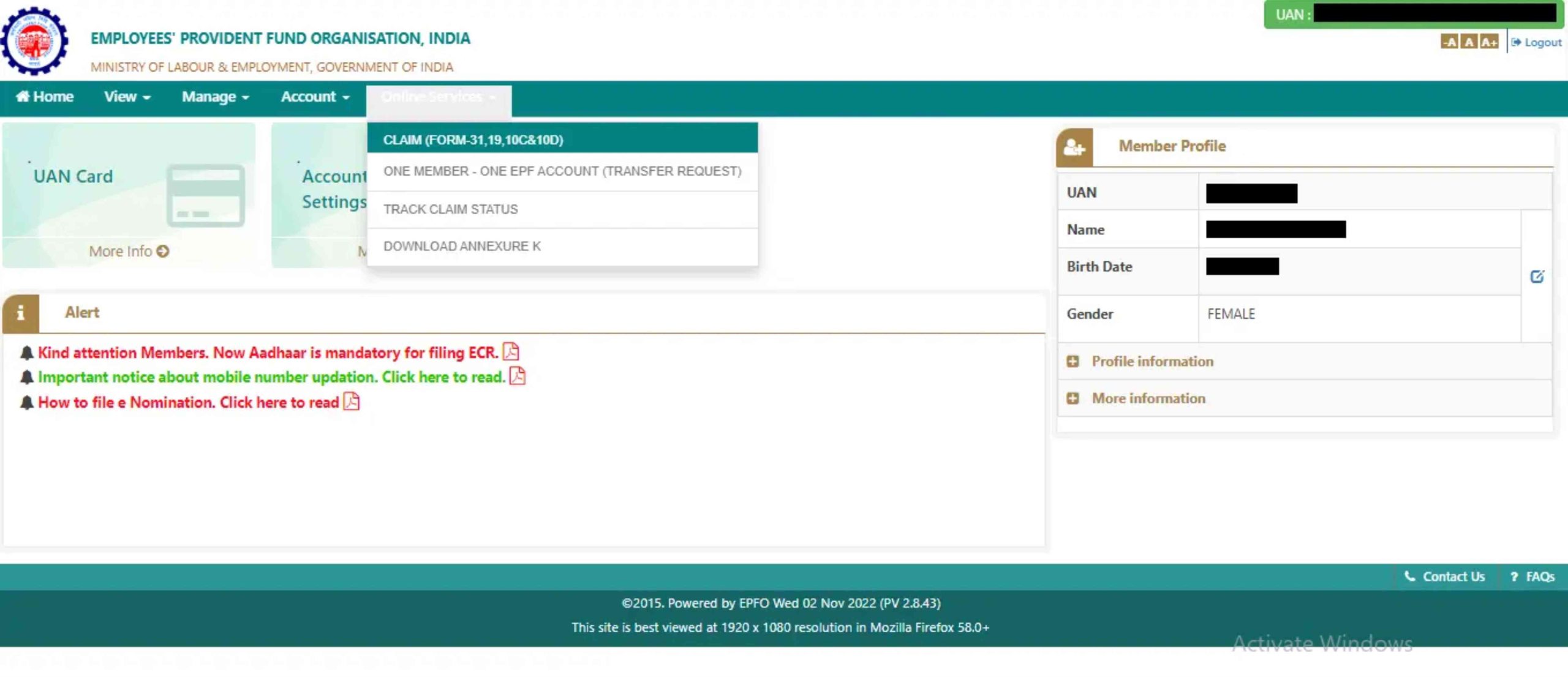

Step 4: Once the KYC details are verified, go to the ‘Online Services’ tab and select the option ‘Claim (Form 31, 19, 10C & 10D)’ from the dropdown menu.

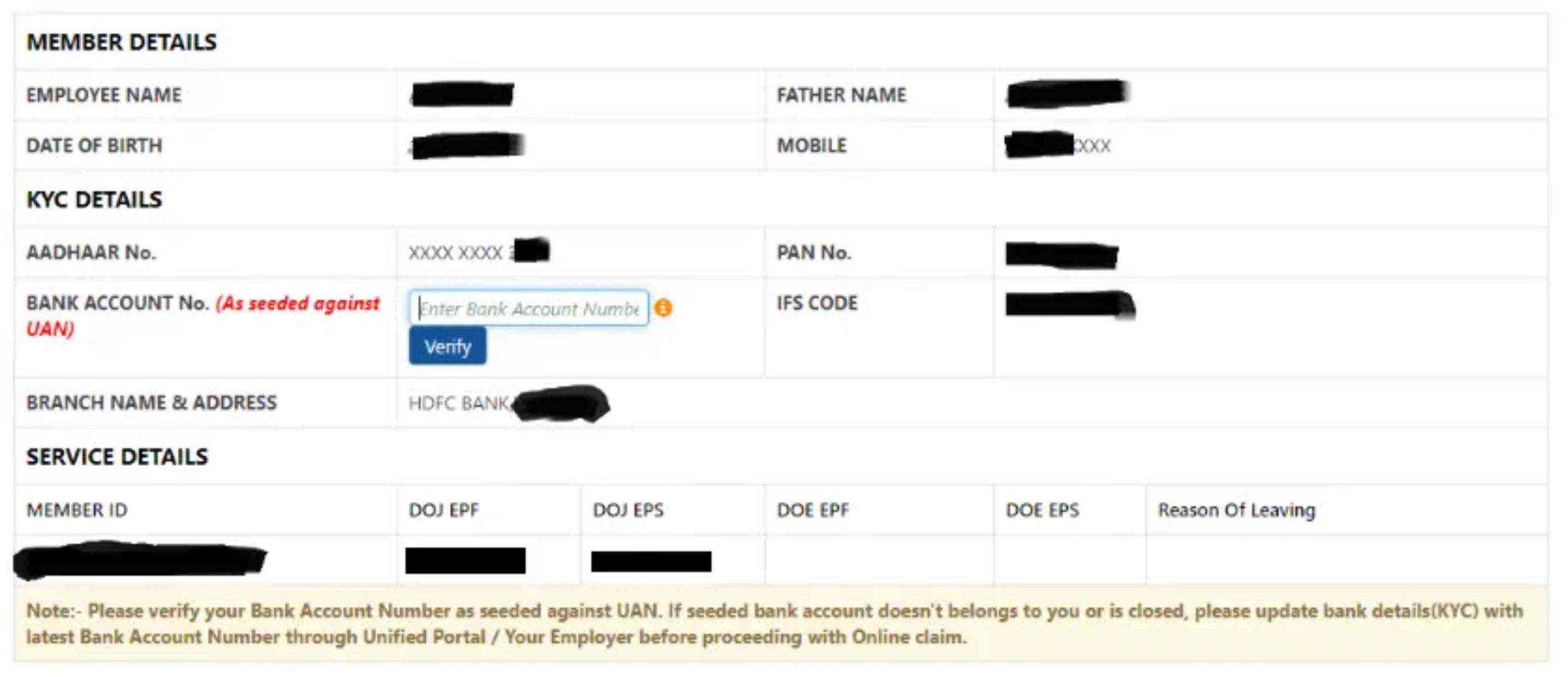

Step 5: The next screen will display member details, KYC details, and other service details. Enter your bank account number and click on ‘Verify’.

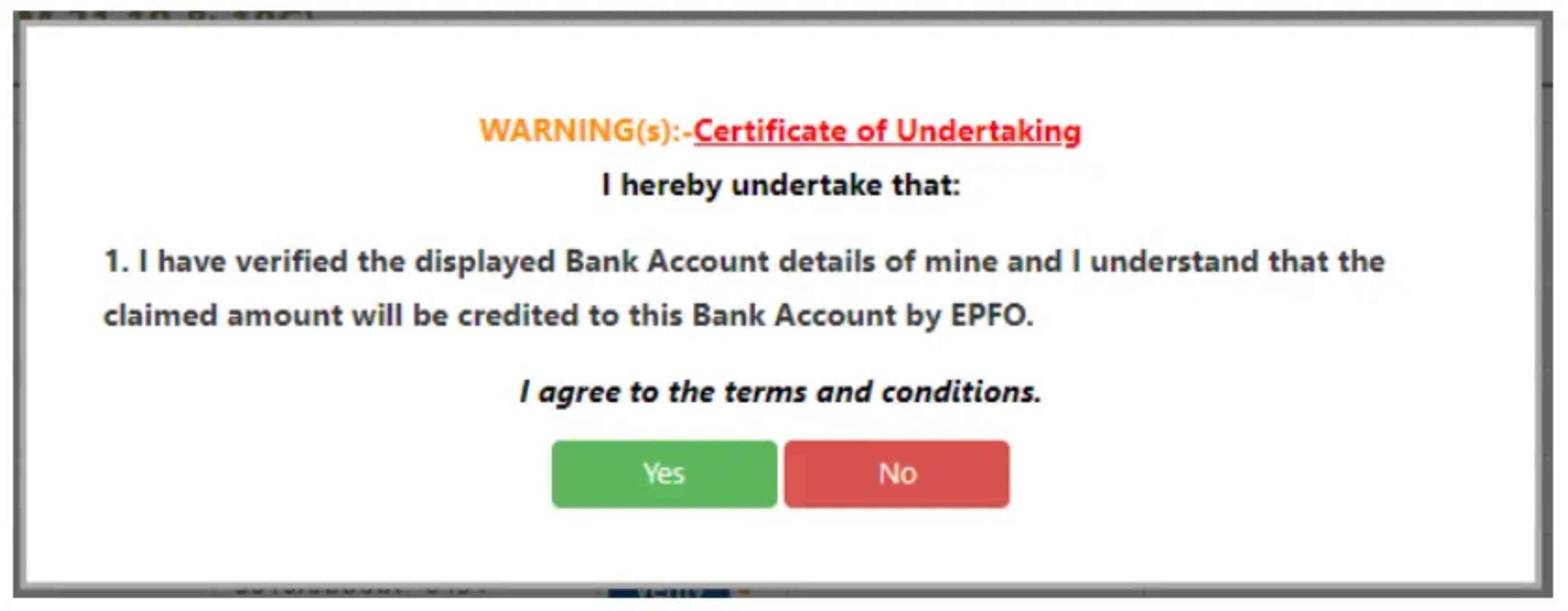

Step 6: Click on ‘Yes’ to digitally sign the undertaking and then proceed.

Step 7: Now, click on ‘Continue for Online Claim’ to proceed with your request to Withdraw Your PF Amount Online?.

Step 8: In the claim form, select the type of claim you require, such as full EPF settlement, EPF partial withdrawal (loan/advance), or pension withdrawal, under the tab ‘I Declare that I Want to Apply For’. If the member is not eligible for any of the services like PF withdrawal or pension withdrawal due to the service criteria, that option will not be displayed in the dropdown menu.

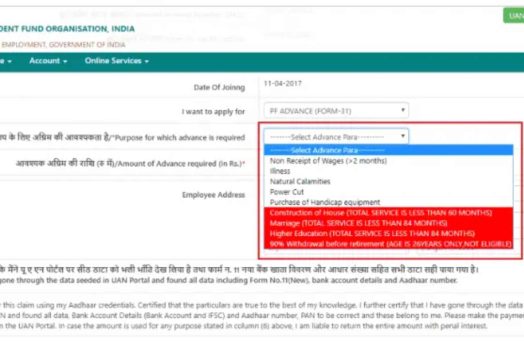

Step 9: Next, select ‘PF Advance (Form 31)’ to withdraw your funds. Provide the reason for such advance, the amount required, and the employee’s address to Withdraw Your PF Amount Online?.

Step 10: Click on the declaration and submit your application. You may be asked to submit scanned documents for the purpose you have filled the form.

EPF Withdrawal Taxability

EPF withdrawal is tax-exempt when an employee has contributed to the EPF account for five continuous years. If there is a break in contributions for five years, the EPF withdrawal amount becomes taxable for that financial year.

TDS is deducted if an employee withdraws the EPF amount before five years and the amount is above Rs. 50,000. The TDS is deducted as follows:

• 10% TDS will be deducted on EPF withdrawal for employees withdrawing more than Rs. 50,000 before completing five years and providing their PAN card.

• When such employees do not provide their PAN cards, a TDS of 30% will be deducted from the amount withdrawn.

• However, no TDS will be deducted if the employee submits Form 15G/15H. You can download Form 15G from the EPFO portal or the website of major banks.

• No TDS is deducted when an employee withdraws the EPF amount after completion of 5 years of continued service, irrespective of the withdrawal amount.

Documents Required for EPF Withdrawal

The following documents are necessary to withdraw your PF amount online:

– Universal Account Number (UAN)

– Bank details of the EPF subscriber

– Identity and address proof

– Cancelled check with IFSC code and account number

Procedure to Enter Leave Date for PF Withdrawal

The leave date should be mentioned for PF withdrawal. The Employees’ Provident Fund Organization (EPFO) has introduced a facility where employees can enter the date of exit from their previous employer in the Unified Member Portal. Previously, only the employer could enter the date of exit, but now even employees can enter the leave date.

Here is the process to enter the leave date:

1. Log in to the UAN portal using the Universal Account Number and password.

2. Click on the ‘Manage’ tab and click on the ‘Mark Exit’ option.

3. From the dropdown option, select the employer.

4. On the new page, enter the date of birth, joining date, and leave date. Mention the leave date as mentioned in the resignation or company leaving letter.

5. You can verify the leave date by clicking on the ‘Service History’ option under the ‘View’ tab after logging into the UAN portal.

How to Check PF Withdrawal Status?

After you apply for PF withdrawal, you can follow the below steps to check the status of your PF withdrawal claim:

1. Log in to the UAN portal using the UAN and password.

2. Click on the ‘Online Services’ tab and click on the ‘Track Claim Status’ option.

3. Enter the reference number.

4. The status will be displayed on the screen.

PF Customer Care Numbers

• PF toll-free number – 14470

• PF missed call number for accessing EPF details – 9966044425

• PF balance enquiry number – SMS “EPFOHO UAN” to 7738299899

• PF email – employeefeedback@epfindia.gov.in

Which are the structures utilized for EPF withdrawal?

EPF Form 19

You should use EPF Form 19 to withdraw EPF funds for final settlement. EPF Form 19 is a two-page form that includes the following sections:

• The first page of the form displays the member’s name, father or spouse’s name, date of birth, name and address of the establishment, date of joining and date of leaving the organization, PF Account Number and UAN, full postal address, PAN (Permanent Account Number), reason for leaving the organization, mode of payment, and the employer and employee’s signatures.

• The second page of the form contains the payment stamped receipt. You should fill out this part if you select a cheque as the payment mode.

How to Fill EPF Form 19?

You can apply to withdraw or transfer the EPF corpus when you are resigning or changing your job. You can fill up the EPF Form 19 online or offline to withdraw your EPF amount.

Steps For Filling The EPF Form 19 Online:

1. Visit the EPFO website and enter your UAN (Universal Account Number), password, and captcha.

2. Click on the ‘Online Services Tab’ and choose the option “Claim (Form 31, Form 19, Form 10C and Form 10D)”.

3. Enter your bank account number linked with your PF account and click on ‘Verify’.

4. A ‘Declaration of Undertaking’ pop-up will appear, and you should select the ‘Yes’ option to proceed.

5. A drop-down menu will appear under the ‘I want to apply for’ option.

6. Choose the ‘Final PF Withdrawal (Form – 19)’.

7. The next screen opens a new section to enter your complete permanent address.

8. Tick off the disclaimer after filling out your address and click on the ‘Get Aadhaar OTP.’

9. Enter the OTP that you receive on your registered mobile number, verify your Aadhaar, and proceed to the next step.

10. You will receive a reference number upon successful submission of your application.

Steps For Filling The EPF Form 19 Offline:

1. Download Form 19 from the EPFO portal and take a printout.

2. Fill in the PF account number, bank account number and IFSC code, PAN, joining and leaving date of your employment, permanent address, mode of settlement, Rs one revenue stamp, and a cancelled cheque to verify the bank account, and submit it to the EPFO office.

EPF Form 31

You can use Form 31 for a partial withdrawal or to avail of an advance from the EPF account. You can access Form 31 from the UAN portal. However, you need your bank account details, PAN, and Aadhaar details to be updated on the portal to apply for an EPF advance.

How To Download EPF Form 31?

How To Submit EPF Form 31 Online?

1. Visit the EPFO portal, sign in using your UAN, password, and fill in the captcha code.

2. Then, visit the ‘Online Services’ tab and select ‘Claim’ to generate your online request.

3. After you click on ‘Claim’, a page appears with details like your name, father’s name, DOB, Aadhaar Number, PAN, Date of joining the organization, and your mobile number.

4. You then click on ‘Proceed for Online Claim’ after verifying all the required details.

5. It would be best if you chose the ‘PF Advance (Form 31)’ option from the dropdown menu.

6. You then choose the reasons for taking the EPF advance and enter your current address and the amount.

7. You should sign the disclosure and check-box the ‘Get Aadhaar OTP.’

8. You must enter the OTP, click on ‘Verify OTP’ and submit the ‘Claim Form’.

What is Structure 10C?

You need to fill and submit Form 10C online to withdraw or transfer your EPS (Employee Pension Scheme) amount. You can download the form at the following link:

How to Fill Form 10C Online?

1. Log in to the EPF portal and enter your UAN and password.

2. Choose ‘Online Services’ from the menu bar.

3. Select the ‘Claim’ tab, which includes Form 19, Form 31, and Form 10C.

4. You will be directed to the next page, where you will see the service history, KYC requirements, and member details.

5. Click on the tab ‘Proceed Online Claim.’

6. You will be directed to the Claims Section, where you can verify details such as PAN, mobile number, bank account number, and UAN number.

7. Enter the last four digits of your bank account number and click ‘Verify’ to verify your details.

8. Click ‘Yes’ on the ‘Declaration of Undertaking.’

9. You will then need to select the claim type as ‘Withdraw PF only’ or ‘Withdraw Pension Only.’

10. Navigate to the menu “I want to apply for” and select “Only Pension Withdrawal (Form 10C).”

11. Enter your permanent address in the Form 10C Section and tick the disclaimer section.

12. Click the tab ‘Get Aadhaar OTP.’

13. An OTP will be sent to your Aadhaar-linked mobile number. Enter this OTP and click on the ‘Verify OTP’ tab and then on the “Submit Claim Form.”

14. After you successfully submit Form 10C, you will receive an SMS notification on your mobile number.

15. Your pension claim will be processed with the filled Form 10C, and the Employee Pension Scheme (EPS) amount will be transferred to your savings bank account.

How To Apply For Home Credit In light of EPF Aggregation?

EPF Home Loan

You can use your EPF savings to purchase a home/flat or construct a house. If you are buying land, you can get up to 24 monthly contributions. You must be in service for five consecutive years to avail of the loan.

To apply for a home loan, you can approach the housing society and submit the application to the EPF Commissioner at the specified address in Annexure 1. The EPF Commissioner will provide a certificate stating the monthly contributions to your EPF account for the past 36 months.

Alternatively, you can take a printed copy of your EPF passbook showing the latest three months’ contributions and submit it to the housing society to estimate the loan amount you can get from the EPF balance.

Steps to Apply for a Home Loan through the UAN Member Portal:

1. Sign in to the UAN Member e-Sewa portal.

2. Select the ‘Online Services’ tab and click on the ‘Claim (Form 31, 19, and 10C)’ option.

3. Your member details will be displayed. Enter your bank account number registered with EPF and click ‘Verify’.

4. Select ‘Yes’ to certify the form.

5. Click on ‘Proceed for Online Claim’ and provide the reason for requesting an advance near ‘I Want to Apply For’. The corresponding options will be displayed if you are eligible from the years of service perspective.

6. Select ‘PF Advance (Form 31)’ to withdraw your funds as an advance or loan. Also, enter the amount you would like to avail of and the employee’s address.

7. Click on the certificate and apply. If prompted, you may be required to upload relevant documents.

8. EPFO processes your application. Upon approval, EPFO makes the payment to the housing society directly.

How To Pull out Your EPF Without UAN?

PF Withdrawal Process

To withdraw your PF, you need to fill the withdrawal form and submit it at the Local Provident Fund Office. You can easily check the jurisdiction of your PF office using the alpha-numeric Provident Fund Account Number, which indicates your state and area as shown on your salary slip.

You should follow the traditional method of PF withdrawal, where you submit your identity proof from a bank manager, judge, or gazetted officer.

Here are some related articles you might find helpful:

1. PF Claim Status

2. How to Find PF Account Number

3. PF Balance Check Online

4. PF Transfer Online Form and Process

5. Online PF Payment

6. Employee Provident Fund Organization (EPFO)

7. Income Tax Customer Care

8. Income Tax

9. Tax Calculator

10. PF Calculator

Frequently Addressed some urgent matters:

Is it mandatory for employees to provide PAN for EPF withdrawal?

It is not mandatory for employees to provide PAN for EPF withdrawal. However, if the EPF withdrawal amount is more than Rs. 50,000 and the service period is less than 5 years, TDS (Tax Deducted at Source) will be applicable, and PAN needs to be provided for this purpose.

Are EPF contributions eligible for tax deductions?

Yes, EPF contributions are eligible for tax deductions under Section 80C of the Income Tax Act, 1961.

Can I increase my EPF contributions?

Yes, you can increase your EPF contributions and contribute up to 100% of your basic salary. This additional contribution goes to the Voluntary Provident Fund (VPF) account.

Will the employer also contribute more when I do?

No, the employer’s contribution remains the minimum regardless of your decision to opt for VPF.

How long does it take to withdraw PF online?

After withdrawing PF online, it takes around 15-20 working days for the amount to be credited to the employee’s account.

Do I need the employer’s permission to withdraw the amount from EPF?

According to new EPF rules, you can withdraw the EPF account without the employer’s permission.

Can I ever make premature withdrawals?

Yes, you can make premature withdrawals under certain circumstances by providing documentary evidence.

What happens to my EPF account once I quit my job or switch jobs?

When you quit or change jobs, your EPF account will no longer receive monthly contributions. However, the account does not become inactive. If you do not join another employer, you have a grace period of three years from your last contribution to withdraw your EPF balance in full.

Will EPFO continue to pay interest on your EPF Account after you leave the company?

If you leave your job before the age of 58 and do not apply for EPF withdrawal within three years from when you are eligible, your EPF account will become inactive, and you will not earn further interest on it.

If you have two EPF accounts, one linked with the previous employer and one with the current employer, how can you withdraw the maximum possible amount?

You can consolidate multiple EPF accounts into one account through your UAN (Universal Account Number). Whenever you change your job, you can view your EPF transactions at the same place. You should submit an application to the EPF Office to combine your EPF Accounts. After you merge your EPF accounts, you can follow the regular EPF Withdrawal process either online or offline.

How long does it take for the EPF claim to be settled?

Your EPF claim may be settled in 20 days or less.

Can I withdraw my EPF money before one year of retirement?

No, you cannot withdraw your EPF money unless you are unemployed. Under current EPF withdrawal rules, if you are unemployed for one month, you can withdraw 75% of your EPF Corpus. Additionally, the balance of 25% can be withdrawn if you are unemployed for more than two months.

If your claim is rejected due to no contribution towards EPF, with only EPF transfer money showing in the EPF passbook, how can you withdraw the EPF Sum?

One of the common reasons for your claim being rejected is that the employer does not make EPF contributions for 2-3 months. There isn’t much you can do about this except ensure your employer regularly contributes to your EPF. It will solve many problems in the future.

How much amount can I withdraw before one year of retirement?

Since the retirement age for most jobs is 58 years, you can withdraw up to 90% of the PF balance with interest when you reach the age of 54, which is one year before retirement.

What is the retirement age to withdraw the entire EPF sum?

The retirement age to withdraw the entire EPF sum is 55 years. Although 90% of the EPF corpus can be withdrawn at the age of 54, one year before retirement.

How can the EPF amount of a deceased employee be withdrawn?

The nominee of the PF account or the legal successor of the deceased employee can withdraw the PF account balance by submitting Form 20 to the PF office. They can withdraw the EPS or pension amount through Form 10D.

What are the requirements for PF withdrawal?

To apply for EPF withdrawal, ensure that the following conditions are met:

• The Universal Account Number (UAN) is activated, and the mobile number used for activating the UAN is in working condition.

• The UAN is linked with your KYC, such as Aadhaar, PAN, bank details, and the IFSC code.

Leave A Comment