Health Insurance: Understanding Coverage and Benefits

Health insurance plays a crucial role in safeguarding individuals and families against the financial burden of medical expenses. It provides a safety net, ensuring that healthcare costs do not become a barrier to receiving necessary treatment. With a variety of plans available, health insurance offers coverage for a range of medical services, including hospitalization, surgery, and preventive care. Understanding the basics of health insurance is essential for making informed decisions about your healthcare needs. This introduction explores the key aspects of health insurance, highlighting its importance and benefits in today’s world.

Understanding Cashless Facilities

Whether health insurance is cashless or not, it is important.If it is not cashless, you have to arrange money initially and then get reimbursed by the company, which involves a lot of paperwork. Therefore, opting for a cashless policy is advisable. In a cashless scenario, you need to ensure that the hospital you choose is in the network of hospitals covered by your insurance company. This is crucial, especially during emergencies when you need immediate treatment. In such cases, you can go to a network hospital, receive treatment, and the insurance company will directly settle the bill with that hospital.

Health Insurance: Pre and Post-Hospitalization Benefits

The second thing you have to check is whether your policy has pre and post-hospitalization coverage. If you have received treatment and submitted the bills to the insurance company, there may still be expenses before and after the treatment. These can include tests, doctor consultation fees, physiotherapy, ambulance charges, and other related costs. It’s important to review your policy to ensure that these expenses are covered.

Additional Considerations for Health Insurance Coverage

Then you have to check all these aspects too. You also have to check whether your insurance has a co-pay option or not. A co-pay is a fixed amount you must pay out of your own pocket for a covered service, usually at the time of service. For instance, if you have incurred an expenditure of Rs. 1 lakh rupees for hospitalization and there is a 5% co-pay clause in your insurance, then you will have to pay Rs.5000 rupees, which is 5% of the total bill.

Additional Considerations for Health Insurance Coverage

Then you have to check all these aspects too. You also have to check whether your insurance has a co-pay option or not. A co-pay is a fixed amount you must pay out of your own pocket for a covered service, usually at the time of service. For instance, if you have incurred an expenditure of Rs. 1 lakh rupees for hospitalization and there is a 5% co-pay clause in your insurance, then you will have to pay Rs. 5000 rupees, which is 5% of the total bill.

Additionally, it’s important to check the cap on coverage before taking insurance, to see if any limit has been set for specific treatments. This is the maximum amount that the insurance company will pay for a particular treatment or service. For example, if you need knee surgery and your insurance has a cap of Rs. 80,000 rupees on that surgery, then you will have to pay the cost exceedingRs. 80,000 out of your own pocket.

When comparing policies, pay attention to the on-claim bonus. Some insurance companies offer bonuses if you do not use insurance in a particular year. These bonuses can take various forms, such as increasing cover amounts, offering free health check-ups, or providing premium concessions. It’s important to consider these factors when choosing an insurance policy to ensure that you get the best coverage for your needs.

Importance of Insurance Company Reputation and Claim Settlement Ratio

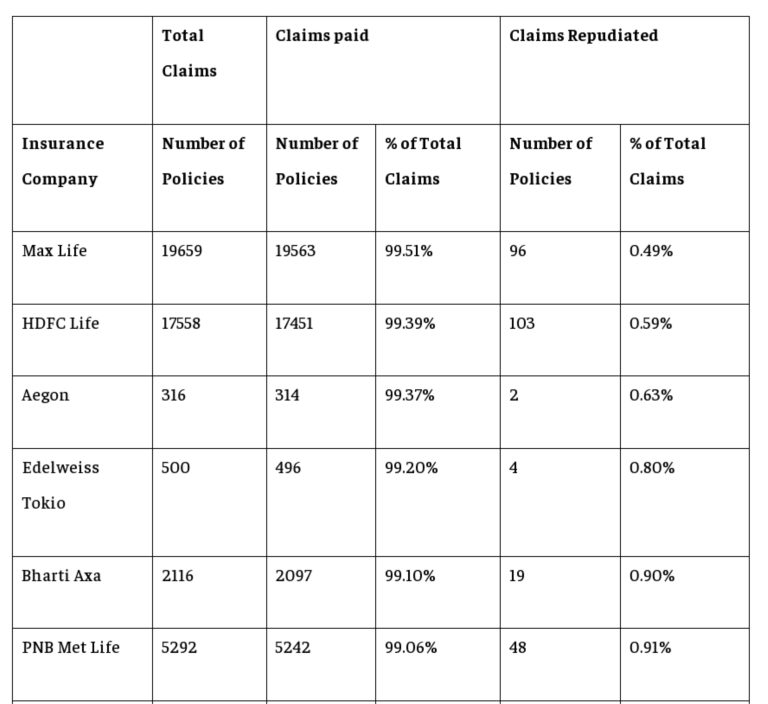

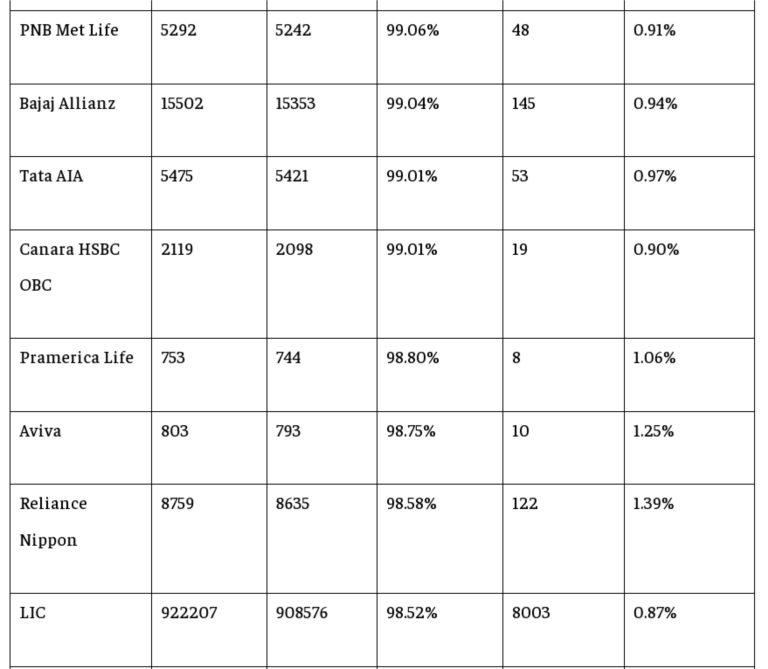

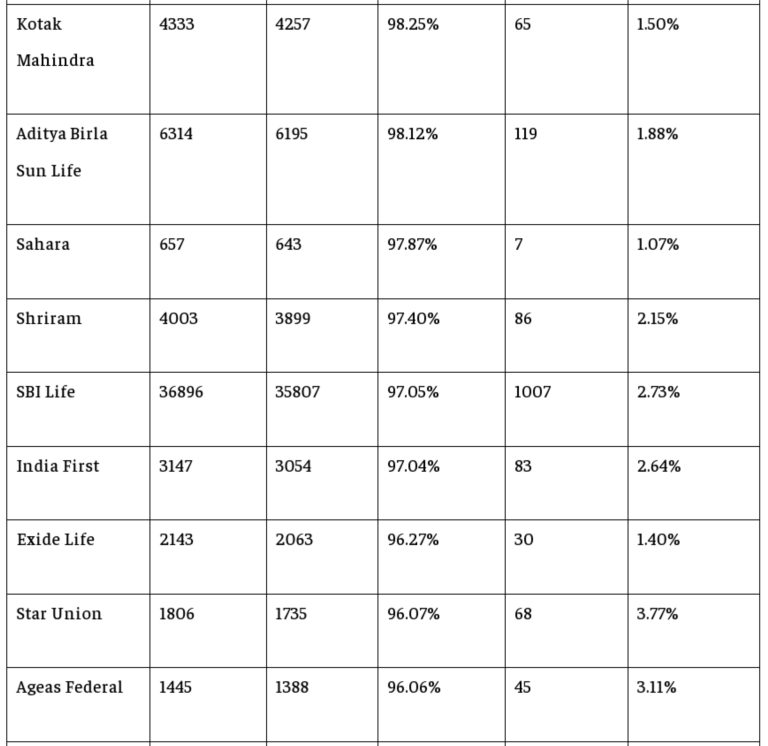

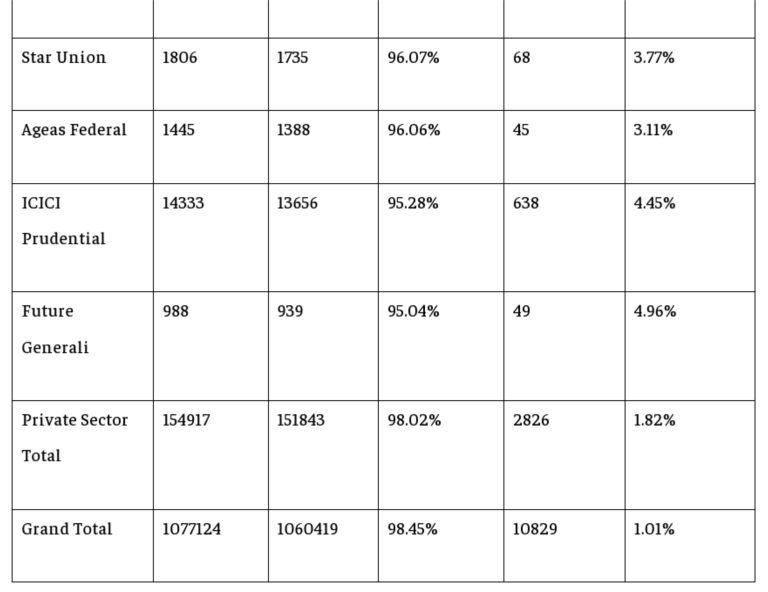

Taking the cheapest health insurance with a low premium in the market may not necessarily solve your problem. It’s important to consider factors beyond just the cost, such as the reputation and claim settlement ratio of the insurance company. The claim settlement ratio indicates the percentage of claims settled by the insurance company against the total number of claims received. A higher claim settlement ratio suggests that the company is more likely to honor your claim when you need it, instead of rejecting it for various reasons.

If you have a pre-existing disease, it becomes even more crucial to choose a policy carefully. Some insurance companies may have specific waiting periods or exclusions for pre-existing conditions. It’s important to disclose all relevant information about your health when applying for insurance to avoid any issues with claim settlement later on.

Disclosure of Pre-Existing Conditions in Health Insurance

It’s important to never hide your pre-existing diseases when applying for health insurance. Doing so can lead to serious consequences, including the termination of your policy. Insurance companies have ways of discovering undisclosed pre-existing conditions, and if they find out, you may lose your premium and have your policy terminated.

In most cases, if you have had a disease within 48 months before taking insurance, it will be considered a pre-existing condition. It’s crucial to disclose all relevant information about your health history when applying for insurance to avoid any issues with claim settlement later on. Transparency is key to ensuring that you receive the coverage you need when you need it.

Room Capping in Health Insurance: Understanding Limits and Coverage

The second aspect to pay attention to is whether there is a cap on room charges in your insurance policy. Hospitals offer different types of rooms, such as deluxe or luxury rooms, and sometimes you may choose these rooms voluntarily or be compelled to take them due to unavailability of other rooms or the hospital’s luxury status. For example, if you opt for a luxury room costingRs.10,000 per day.

If your insurance policy does not have a cap, you can choose any room without restrictions. However, if there is a cap, you will not receive the full amount for the room rent. In such cases, the insurance company may state that if you wish to avail a room with higher charges, you should opt for a policy with a higher coverage amount. For instance, if your insurance coverage is Rs. 5 lakhs, you may get a room rent coverage of up to Rs. 5,000, which is typically around 1% of the total policy amount.

However, this scenario poses a problem if the hospital bill exceeds the room rent coverage. For example, if the total bill is Rs. 3 lakhs and the insurance company covers only Rs. 5,000 for the room rent, you will have to pay the excess amount out of your pocket. Some insurance companies even link the entire insurance coverage with the room rent. This means if you choose a room costing Rs. 10,000, but the insurance company allows only Rs. 5,000 for room rent, they will pay only 50% of your entire hospital bill, including medicines and treatment. Therefore, it’s crucial to check if your policy is linked to room rent when setting up insurance.

Types of Health insurance

Health insurance plans typically come in two main types: individual plans and family floater plans.

Individual Plans:

These provide coverage for a single individual. The sum assured is applicable to each insured person individually.

Family Floater Plans:

These cover the entire family under a single policy. The sum assured can be used by any family member covered under the policy.

Individual plans are suitable for those who want coverage for themselves, while family floater plans are beneficial for families seeking coverage for all members under a single policy, which can be cost-effective compared to multiple individual plans.

Understanding Individual and Family Floater Plans

You can choose an individual plan for yourself based on your insurance needs. With an individual plan, only you are covered under the policy.

On the other hand, a family floater plan covers your entire family under a single policy. For instance, if you opt for a family floater insurance ofRs.5 lakhs, the sum insured can be used by any family member who falls ill. However, there is a limitation to this plan. If multiple family members fall ill and require treatment, the insurance company will not provide more than the total sum insured (Rs. 5 lakhs in this example) for all the claims combined.

While a family floater plan offers the advantage of covering the entire family under one policy, it also comes with limitations. It’s important to assess your family’s health needs and history before deciding on the type of insurance plan to opt for.

Considerations for Family Floater Plans with Senior Citizens

Insurance companies operate as businesses and aim to make a profit. When it comes to family floater plans, the premium is calculated based on the age of the eldest member of the family. If there are more senior citizens in your family, the premium for the family floater plan will be higher compared to an individual plan for a younger person.

To manage costs more effectively, it is advisable not to include senior citizens in a family floater plan. Instead, consider taking out separate individual insurance policies for them. This approach can be more cost-effective and ensure that each family member gets adequate coverage tailored to their specific needs.

Determining Your Health Insurance Coverage

Determining the appropriate amount of health insurance coverage depends on several factors, including your age, family medical history, presence of pre-existing conditions, and lifestyle habits. As a general guideline, if you are under 30 years old, it is recommended to have a minimum coverage of three lakhs. If you opt for a family floater plan, the coverage should be at least Rs. 500,000.

However, these are general recommendations and the actual amount of coverage needed can vary based on individual circumstances. It is advisable to assess your specific health needs and financial situation before deciding on the amount of health insurance coverage to purchase.

Health Insurance Considerations for Metro Cities

Living in metro cities can indeed result in higher healthcare costs due to higher treatment expenses and increased cost of living. In such cases, it is advisable to consider a higher amount of health insurance coverage to ensure adequate financial protection. Some experts suggest that your health insurance coverage should be at least 50% of your annual income. Additionally, you may want to consider matching the coverage amount to the cost of a major medical procedure, such as heart surgery, in a hospital in your area. This approach can help you manage unexpected medical expenses more effectively.

Tax Benefits of Health Insurance: Section 80D

One of the benefits of having health insurance is the tax benefit you can avail under Section 80D of the Income Tax Act. Under this section, you can claim a deduction of up toRs.25,000 for the premium paid towards health insurance for yourself, your spouse, and dependent children. Additionally, you can claim an additional deduction of up to Rs. 25,000 for the health insurance premium paid for your parents, which increases to Rs. 50,000 if your parents are senior citizens. This tax benefit can help reduce your taxable income and lower your overall tax liability.

Frequently Asked Questions

What is health insurance and why is it important?

Health insurance provides financial protection against medical expenses, ensuring that healthcare costs do not become a barrier to receiving necessary treatment. It offers coverage for various medical services including hospitalization, surgery, and preventive care.

What are cashless facilities in health insurance?

Cashless facilities allow policyholders to receive treatment at network hospitals without paying upfront. The insurance company directly settles the bill with the hospital, eliminating the need for reimbursement and reducing paperwork.

What is pre and post-hospitalization coverage?

Pre-hospitalization coverage includes expenses incurred before being admitted to the hospital, such as diagnostic tests and consultations. Post-hospitalization coverage includes follow-up consultations, tests, and treatments after being discharged.

What is a co-pay in health insurance?

A co-pay is a fixed amount that the insured must pay out of pocket for a covered service at the time of service. For example, if your policy has a 5% co-pay and your hospital bill is Rs. 1 lakh, you would need to pay Rs. 5,000.

What is a coverage cap in health insurance?

A coverage cap is the maximum amount an insurance company will pay for a specific treatment or service. If the cost exceeds this cap, the insured must pay the difference.

What is a no-claim bonus?

A no-claim bonus is a reward given by insurance companies if no claims are made in a policy year. It can take the form of increased coverage amounts, free health check-ups, or premium concessions.

Why is the claim settlement ratio important?

The claim settlement ratio indicates the percentage of claims settled by an insurance company out of the total claims received. A higher ratio suggests a higher likelihood that the company will honor your claim.

What should I know about pre-existing conditions and health insurance?

Disclose all pre-existing conditions when applying for insurance. Some policies have waiting periods or exclusions for these conditions. Hiding such information can result in policy termination and loss of coverage.

What is room capping in health insurance?

Room capping limits the amount an insurance policy will pay for room charges. If the room cost exceeds the cap, the insured must pay the difference. Some policies link overall coverage to room rent, impacting total reimbursement.

What are individual and family floater plans?

Individual plans cover a single person, while family floater plans cover the entire family under one policy. The sum insured can be used by any member under a family floater plan, making it cost-effective compared to multiple individual plans.

Should I include senior citizens in a family floater plan?

Including senior citizens in a family floater plan can increase premiums. It might be more cost-effective to take separate individual policies for them, ensuring adequate coverage for each family member.

How much health insurance coverage do I need?

The amount of coverage depends on factors like age, family medical history, pre-existing conditions, and lifestyle. Generally, it’s recommended to have a minimum coverage of Rs. 3 lakhs if under 30, and at least Rs. 5 lakhs for family floater plans.

How should I determine health insurance coverage in metro cities?

In metro cities, consider higher coverage due to increased healthcare costs. Experts suggest coverage should be at least 50% of your annual income or equivalent to the cost of a major medical procedure in your area.

What tax benefits are available under health insurance?

Under Section 80D of the Income Tax Act, you can claim a deduction of up to Rs. 25,000 for premiums paid for yourself, spouse, and dependent children. An additional Rs. 25,000 can be claimed for parents, increasing to Rs. 50,000 if they are senior citizens.

One Reply to “Health Insurance”

[…] What is Co-Pay in Health Insurance? […]